So you’ve secured a mortgage and are looking forward to moving into your first home. Hold your horses, for your home-owning expenses do not end there. It takes more to buy and finance a property than just paying the deposit and home loan.

Many first-time homeowners are befuddled when they discover that the path of owning a home is freighted with a series of miscellaneous (and often unexpected) hidden homeowner costs.

Here are some extra costs that homeowners will need to look out for before settling in.

1. Property assessment tax (cukai pintu)

Property assessment tax or cukai pintu, is imposed by your local authority on every household to finance the construction and maintenance of public infrastructure, cleaning services and upgrading works in the area under its jurisdiction.

The tax is calculated based on the (estimated) annual rental value of a property (what the property can be reasonably rented for, multiply by 12 months), and then multiplied by a set of rates. This set of rates is determined by local authorities, generally at a rate of 4% for residential units and 10% for commercial property.

It is payable in two instalments annually, on or before February 28 or 29 (for the period of January to June), and on or before August 31 (for the period of July to December).

If a residential property’s annual rental value amounts to RM12,000 per annum (RM1,000 per month), the current 4% rate would amount to a tax of RM480 in a year.

Annual rental value of a property varies according to factors such as market rate, location and condition of the property.

2. Quit rent (cukai tanah)

Besides the assessment tax, the other main cost associated with property and land ownership in Malaysia is quit rent or cukai tanah. It is a form of land tax collected by State Governments and is imposed on owners of freehold or leased land.

The National Land Code makes it compulsory for all landowners to pay quit rent, typically on or before May 31. It is to be paid once a year to the relevant land office.

The amount of quit rent you need to pay varies from state to state and even within each state. In Kuala Lumpur, the chargeable rate for quit rent is about RM0.035 per square foot per annum (the rate may differ for different locations). This is the highest income contributor to the Kuala Lumpur City Council (DBKL).

If you own a 2,500-square-foot terrace house, you will have to pay RM87.50 in quit rent every year. The quit rent liability for residential properties is generally estimated to be less than RM100 per year.

3. Home insurance

Home insurance (also referred to as homeowner insurance, householder insurance or houseowner insurance) provides coverage for a homeowner from damages caused by theft, natural disasters, accidents, vandalism and other risks.

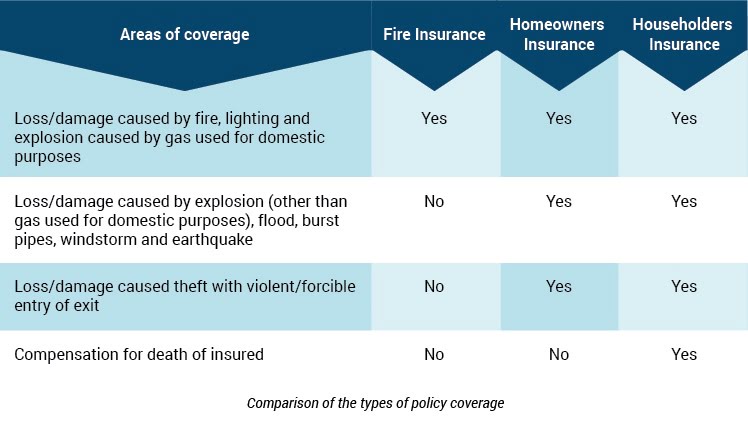

There are three main types of home insurance policies in Malaysia to protect homeowners, their property and household goods:

a) Homeowners fire insurance policy

This policy covers the loss or damages to your property building and contents caused by fire, lightning and explosion of gas used for domestic purposes only.

b) Homeowners insurance policy

This policy provides additional coverage compared to the basic fire insurance policy. It covers your building, including fixtures and fittings, garages, walls, gates and fences, against specific risks. This may include loss or damage due to flood, burst pipes, theft, windstorm and earthquake.

c) Householders insurance policy

This policy covers your household contents, including moveable possessions, against specific risks. It also provides fatal injury coverage to the person injured. However, it does not cover damage to the house itself.

These policies can be bought separately and/or together. Home insurance is not compulsory, but it will alleviate some of your worries and anxieties, and protect your family against the unexpected.

The type of insurance you should get is dependent on your lifestyle, locality and risk factors. For example, you might want to consider homeowners or householders insurance if floods are a regular occurrence at your area.

4. Mortgage insurance

In Malaysia, there are two types of mortgage insurance available – Mortgage Reducing Term Assurance (MRTA) or Mortgage Decreasing Term Assurance (MDTA) and Mortgage Level Term Assurance (MLTA).

They are basically a form of insurance for your home loan. Both offer protection for the homeowner by helping them settle their outstanding home loan in the event of illness, disability or death.

Despite what your banker might tell you, it is not compulsory to buy MRTA or MLTA, but having mortgage insurance gives you peace of mind and protects your family from the risk of losing a home.

The table below shows the difference between MRTA and MLTA:

How much premium you need to pay for your MRTA or MLTA is subject to your age, loan amount and your loan tenure. The older you are and the higher the loan amount, the more premium you will have to pay. The type of mortgage insurance you require will depend on your needs, number of financial dependants and lifestyle.

For instance, MRTA might be more suitable for the single individual with zero financial dependents. However, this is provided that he or she is able to afford the lump sum payment. It is also more suitable for those who are planning to own property for the long term, as MRTA is non-transferable.

Meanwhile, MLTA might be more suitable if you have one or more financial dependents. A plus point is, MLTA pays directly to you or your nominee should something bad happen. It also provides accumulation of cash value, which you will be able to access after your loan tenure. The downside is of course, you will have to fork out a bigger premium.

5. Indah Water utility bill

Indah Water Konsortium (IWK) is mainly responsible for operating and maintaining the public sewage treatment plants and network of underground sewerage pipelines.

In 1994, the Federal Government awarded the company the concession for nationwide sewerage services which prior to that, was under the responsibility of local authorities. Since then, IWK has taken over the sewerage services from local authorities in all areas except the states of Kelantan, Sabah, Sarawak and Johor Bahru.

For IWK’s sanitary disposal services of household wastes, domestic premises like houses are generally billed RM8 per month (27 sen a day) for sewerage systems that are connected to a public sewage treatment plant or RM6 per month (20 sen a day) for those with an individual septic tank.

6. Maintenance fees

If you stay in a strata-titled property, you most probably have to pay for maintenance fees and sinking fund. These are paid to the management office of your property every month.

The maintenance fees are paid to cover general costs, and management costs to upkeep the common areas and the facilities of the condominium.

The sinking fund is paid in advance for any major fixtures, fittings or repairs needed for the building, including painting of the buildings.

Just like quit rent, these fees are calculated based on the size of your property, hence the bigger your condominium is, the larger the payment. However before the sinking fund is used, it has to be upon the majority of votes of the tenants who reside in the building.

An average rate for maintenance fee in the Klang Valley is about RM0.20 per square foot. A 1,200 square feet condominium will cost about RM240 a month in maintenance fee.

Owning a property is not easy or cheap. After getting over the hurdle of paying the down payment and getting a home loan approved, you still need to continuously fork out money to pay for all these expenses. If there is any repair work that needs to be done (it will definitely happen during your home ownership), that will spell more money out of your pocket.

Source: iMoney.my